Although biologics and biosimilar drugs only represent 2% of U.S. prescription volume, these naturally sourced medications have recently become the focus of much discussion across healthcare channels. Biologics – often considered specialty drugs – have accounted for as much as 37% of drug spending in a single year.

How Biologics and Biosimilars Help Fight Chronic Disease

The overall specialty biologic market growth is projected to continue at a rate of 8% yearly and by 2025, will account for $62 billion in prescription drug spend – and biologics are no exception to this broader trend. How the term “specialty drug” is used across the healthcare landscape can vary. But while there isn’t a standardized definition, basic elements include:

- Treatment of chronic, complex, or rare diseases

- Very high cost

- Complicated administration protocols or special handling

- Procurement through non-traditional distribution channels

Biologics are particularly well-suited to treat conditions associated with inflammation and immune system dysfunction – a broad category that includes rheumatoid arthritis, gastrointestinal diseases, skin disorders, and various types of cancer, among others.

Enter biosimilars. They are designed with similar properties and a specific goal of reducing cost and access barriers to these therapies. According to the FDA, a biosimilar is a biological product that is highly like the existing FDA-approved reference product. (The FDA approved the first biosimilar as recently as 2015).

Generics vs Biosimilars: What’s the Difference?

In comparison to generics, which are exact copies of the reference branded drug, biosimilars are manufactured as highly similar to the original biologic drug. Although not an exact copy of the original, biosimilar drugs are designed to create the same therapeutic result in humans.

In the U.S., an emerging pipeline of about 90 biosimilars is projected to enter the market in the next 3-5 years with the hope that competition allows for more affordable alternatives. To date, there have been 40 approvals and 25 launches in the U.S. market spanning a variety of diseases and therapeutic classes such as:

- Endocrine: (Lantus)

- Ophthalmology: (Lucentis)

- Oncology: (Herceptin, Avastin, Rituxan)

- Oncology Supportive Care: (Neupogen, Neulasta, Epogen)

- Inflammatory Conditions: (Remicade, Enbrel, Humira).

Biosimilars on average, are 15% to 35% less expensive than their branded reference relatives, and therefore, fundamentally impact the pharmaceutical market by lowering drug costs through more competition. According to the RAND Corporation, their adoption can reduce drug costs in the U.S. by more than $100 billion over a five-year period.

As this market matures, the pipeline will continue to grow and expand into new therapeutic areas, including growth hormone, infertility, bone health, and immunosuppressants.

Increasing Provider Awareness of Biosimilar Drugs

The more that life sciences brands expand their development of biosimilar drugs, the more they’ll need to focus on increasing provider awareness of product availability as well as providers’ direct experience using them to improve patient outcomes.

Life sciences organizations can and should rely on real-world data (RWD) to enhance providers’ knowledge of biosimilar drugs. Provider education and adoption go hand in hand, but how this occurs after a biosimilar drug is developed depends on the status of FDA approval for each drug’s interchangeability as well as payer drug formulary policies.

For example, biosimilars may not be approved for all the reference product indications, a practice called “skinny labeling.” Providers may also be hesitant to switch due to a lack of familiarity with the full biosimilar offering. On the other hand, providers who frequently treat patients with conditions for which biologics are the cornerstone of therapy – such as the treatment of arthritis with Remicade biosimilars – are more inclined to prescribe a biosimilar for a new start or switch to a comparable, lower-cost biosimilar.

How the HealthNexus Platform Enables Provider Education

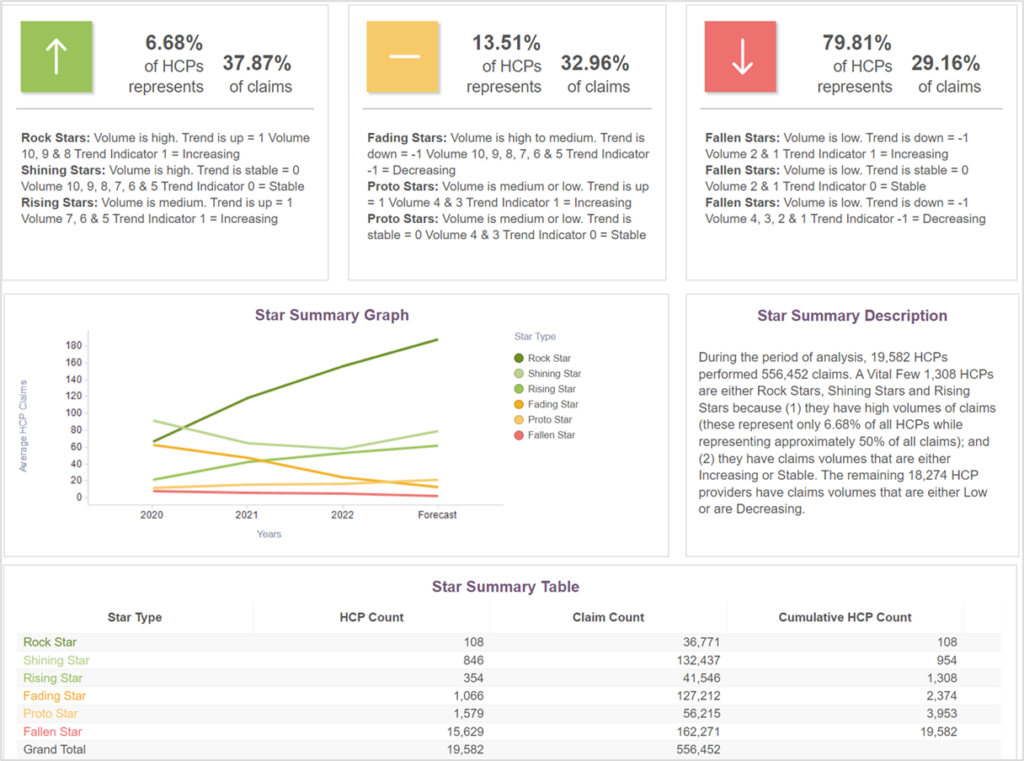

PurpleLab’s HealthNexus™ platform can help identify specific providers who have experience with diverse patient populations and complex therapy. It allows for peer-to-peer comparison classified into a decile according to their prior performance and predicted trends. As shown in the figure below, the platform uses a star system to identify practice patterns that are crucial when looking for experienced providers who treat these kinds of complex conditions.

Figure 1. Comparative Physician Experience with Remicade

Using criteria such as the diseases providers treat, the drugs they prescribe, and the demographics of their unique patient populations, the HealthNexus platform can identify segments of providers in any market in the U.S. Those specific providers can then be compared at the local, state, and national level, allowing users to determine the most appropriate disease management and drug therapy.

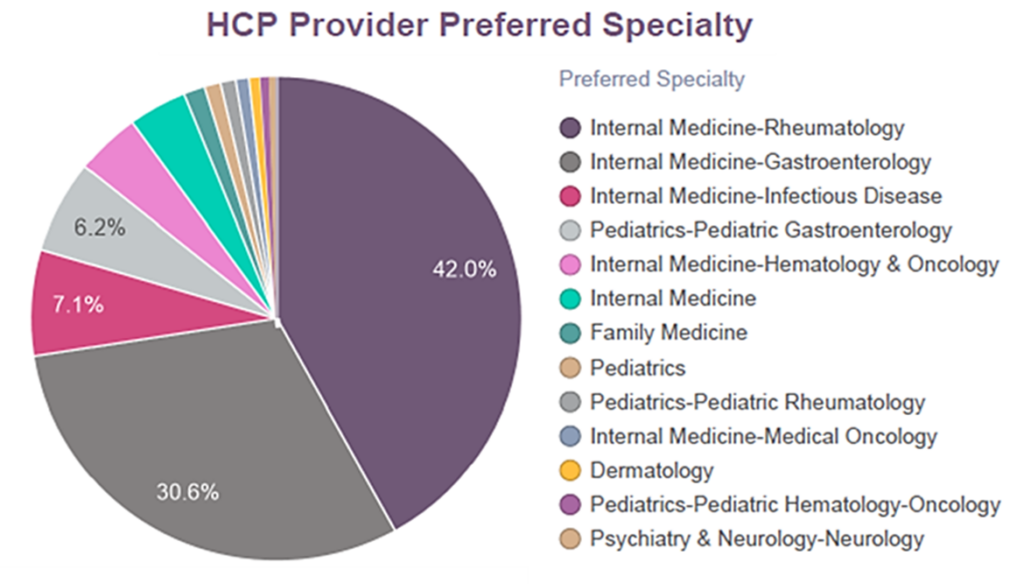

Using PurpleLab’s HealthNexus Provider Experience reporting, we looked at provider specialty related to a specific biologic reference, Remicade, and providers’ history of prescribing biosimilars of this drug. Among the various specialties that prescribed Remicade and its biosimilars (as shown in Figure 2), providers who had more experience prescribing Remicade were more likely to prescribe biosimilars Renflexis, Inflectra, and Avsola (not shown).

Fig. 2 Healthcare Provider Specialty

The increased use of biosimilars has the potential to result in significant cost savings across the U.S. Before that can happen, however, there are multiple gaps that need to be addressed. In many therapeutic areas, biosimilars still face slow adoption due to a lack of provider education or familiarity. Additionally, some patients experience poor real-world outcomes from switching across these agents for various reasons, (e.g., immunogenicity, safety, efficacy).

Addressing gaps in evidence is critical to increasing patient and provider confidence to prepare for a biosimilar influx. PurpleLab’s HealthNexus Provider Experience Reporting also accounts for variability in patient characteristics (not just medical, but financial and behavioral), typically not captured.

Our platform offers insights beyond just trending, such as the ability to identify multiple switching across biologics and biosimilars, not uncommon with these drugs. Understanding prescribing at this level will have an overall impact on biosimilar utilization and these more affordable therapies.

Contact us to learn more about HealthNexus™ powered by PurpleLab™ and to see how our platform can help you manage and use your healthcare data.