More than a year has passed since Humira biosimilars were launched in the US, and with these, several other biosimilar drug approvals that either directly compete with Humira or are indicated for other rare immunologic conditions, macular degeneration, and oncology and hematological disease. Ongoing industry surveillance of biosimilars and the

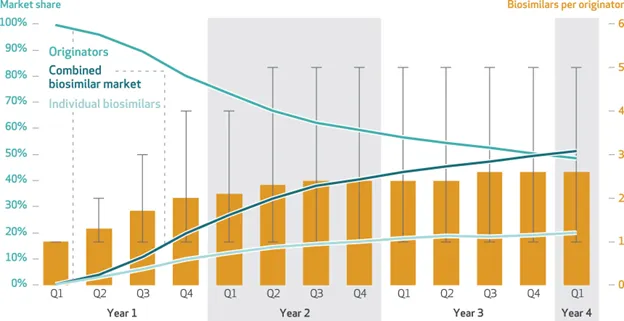

value proposition they offer is closely being scrutinized, with many organizations tasked in securing this confirmatory evidence. Timing has shown to be a key factor related to both post-launch adoption and utilization of individual biosimilars, alternatives, and in some cases, competitive products that simultaneously enter the market. Consequential savings appears to play out a few years after launch; after the actual lower net cost of biosimilars has time to settle.

Between 2017-2022, biosimilar market share surpassed reference counterparts and accounted for about a third of total cost in savings within the medical benefit. A similar cost- savings timing trajectory was observed when looking at adalimumab biosimilars in commercial payer pharmacy benefit. So, although it has taken some time, with payers expanding availability of one or more preferred biosimilars or replacing the reference product altogether, these changes have created the momentum needed to gain more widespread utilization. Medical organizations like American College of Rheumatology have gone a step further and published their endorsement for the use of biosimilars to reduce costs and increase patient access in a recent position statement.

PurpleLab recently shared insights related to these challenges from real-world data analysis, detailing how data can be the differentiator around efforts to increase the adoption of biosimilars by providing a deeper understanding of the continuously evolving payer, provider and market landscape. The analysis showed that biosimilar prescribing varied with provider specialty for both non-oncology and oncology condition treatment. PurpleLab’s HealthNexus reporting analytics extends beyond trending; offering insights not typically captured in traditional reporting and data analysis and key insights for provider organizations to develop strategies that focus on awareness campaigns and enable pharma companies to identify shifting specific to biosimilar utilization. A recent survey from employer health plans shows healthcare premiums have increased more than 7% since 2023, resulting in an increase in total cost of care and higher out of pocket costs for patients with more complex conditions. With the biologic market projected to continue this expansion in 2025, payers are following suit with more creative strategies for highly competitive biosimilar approvals. PurpleLab’s data-driven insights is critical to uncovering gaps in biosimilar provider familiarity so they can be targeted to address unmet patient opportunities and the ongoing awareness needed to demonstrate the significant projected savings from this class of medications.

Resources:

- https://www.fda.gov/drugs/biosimilars/biosimilar-product-information

- https://employercoverage.substack.com/p/biosimilars-are-finally-widely-available

- https://www.jmcp.org/doi/10.18553/jmcp.2024.24036

- https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2023.01532

- https://www.fiercehealthcare.com/payers/optum-rx-pull-humira-some-its-preferred-formularies-report?utm_medium=email&utm_source=nl&utm_campaign=HC-NL-FierceHealthPayer&oly_enc_id=4280E4288056J2I

- https://assets.contentstack.io/v3/assets/bltee37abb6b278ab2c/bltf25f8abcefb66dbb/acr-position-statement-biosimilars.pdf

- https://www.biopharmadive.com/trendline/biosimilars/47/?preview_no_gate=trendline_47

- https://www.kff.org/report-section/ehbs-2024-summary-of-findings/

- https://www.cardinalhealth.com/en/product-solutions/pharmaceutical-products/biosimilars/biosimilars-report.html

- https://www.fiercehealthcare.com/payers/evernorths-accredo-make-stelara-biosimilar-available-0-out-pocket?utm_medium=email&utm_source=nl&utm_campaign=HC-NL-FierceHealthPayer&oly_enc_id=4280E4288056J2I